Setting up computerized funds ensures that loans are repaid on time, which might help preserve a constructive credit score rating.

Setting up computerized funds ensures that loans are repaid on time, which might help preserve a constructive credit score rating. Additionally, if monetary struggles arise, girls mustn't hesitate to speak with their lenders relating to potential adjustments to their cost pl

The absence of collateral means that lenders assume a higher danger when granting unsecured loans. Consequently, rates of interest may be greater compared to secured loans. The most common forms of unsecured loans embody personal loans, credit cards, and pupil loans. These loans could be utilized for various purposes, similar to

Debt Consolidation Loan consolidation, medical bills, or residence enhanceme

In at present's fast-paced world, people usually discover themselves in sudden need of money. Whether it's an surprising medical expense or a last-minute invoice, financial emergencies require immediate action. This is the place 24-hour loans come into play, offering a fast solution for urgent financial needs. These short-term loans enable individuals to entry cash rapidly, often inside simply at some point. However, understanding how they work, their professionals and cons, and the place to search out dependable info is crucial for making informed choices. Platforms like 베픽 offer complete resources about 24-hour loans, making it easier

Loan for Bankruptcy or Insolvency for customers to navigate this financial landsc

The mortgage term can even influence your interest rate. Typically, shorter loan terms come with decrease interest rates but larger month-to-month payments. Conversely, extended loan terms can lead to larger charges, but the benefit lies in lower monthly payments. Analyzing these factors is important when figuring out your financing choi

Yes, most lenders allow early compensation of unsecured loans, however it’s advisable to examine for any prepayment penalties. Paying off your loan early can save you on curiosity prices, but make positive you fully perceive the lender’s policies concerning early repaym

Moreover, auto loans offer various choices concerning the sort of vehicle you should buy. Depending on the scale of the loan, debtors can opt for new or used vehicles, increasing their choices. Implementing due diligence in choosing the best vehicle, mixed with the advantages of auto loans, can significantly enhance total satisfaction and guarantee sound financial decisi

Borrowers should demonstrate a steady earnings and a great credit rating to qualify for unsecured loans, as these elements closely influence the mortgage approval process and interest rates. Understanding the necessities and implications of unsecured loans is vital for anyone considering this select

The way forward for women’s loans looks promising as more lenders recognize the significance of supporting feminine debtors. Innovative programs and flexible terms are anticipated to extend, providing ladies with more opportunities to entry the funds they should thr

How to Apply for Unsecured Loans

The application course of for unsecured loans is generally simple. Borrowers usually start by checking their credit score scores to understand their skills higher. A larger rating can lead to better rates and more favorable terms, which motivates people to maintain good credit practi

Exploring Bepick for Monthly Loan Insights

Bepick is a useful resource for individuals trying to collect detailed information and reviews about month-to-month loans. The web site provides complete articles, comparisons, and guides to help customers navigate via various loan choices obtainable available in the mar

Exploring Bepick for Auto Loan Insights

For these in search of a comprehensive understanding of auto loans, Bepick is an invaluable resource. The website supplies intensive data, breaking down numerous elements of auto loans to empower consumers with the data needed for knowledgeable decision-making. Reviews of various lenders, loan varieties, and interest rates are presented clearly and helpfu

Understanding the qualification criteria for women’s loans is crucial for securing funding. Generally, lenders assess a borrower’s credit score history, revenue, and financial stability to discover out eligibility. Women ought to make sure that they preserve an excellent credit score score and have all needed paperwork prepa

Unsecured loans have become a preferred monetary resolution for individuals on the lookout for funds with out the necessity to provide collateral. This article delves into the intricacies of unsecured loans, explaining how they work, their benefits, and concerns to remember. Whether you are looking for

Personal Money Loan finance options or exploring business loans, understanding unsecured loans is crucial for making informed choices. Additionally, we will introduce BePick, a dedicated platform offering comprehensive evaluations and data on unsecured lo

After acquiring a loan, managing compensation becomes a precedence. Having a clear reimbursement strategy is vital to keep away from monetary difficulties in the future. It's essential to create a budget that comes with mortgage payments, allowing for a structured strategy to finan

Dewa212 – Evolusi Game Slot Online dari Konvensional ke Digital

Ved Hoki69 car

Dewa212 – Evolusi Game Slot Online dari Konvensional ke Digital

Ved Hoki69 car Hallmark's Fantasy Series: Tales From a Neverending Story

Ved sh er

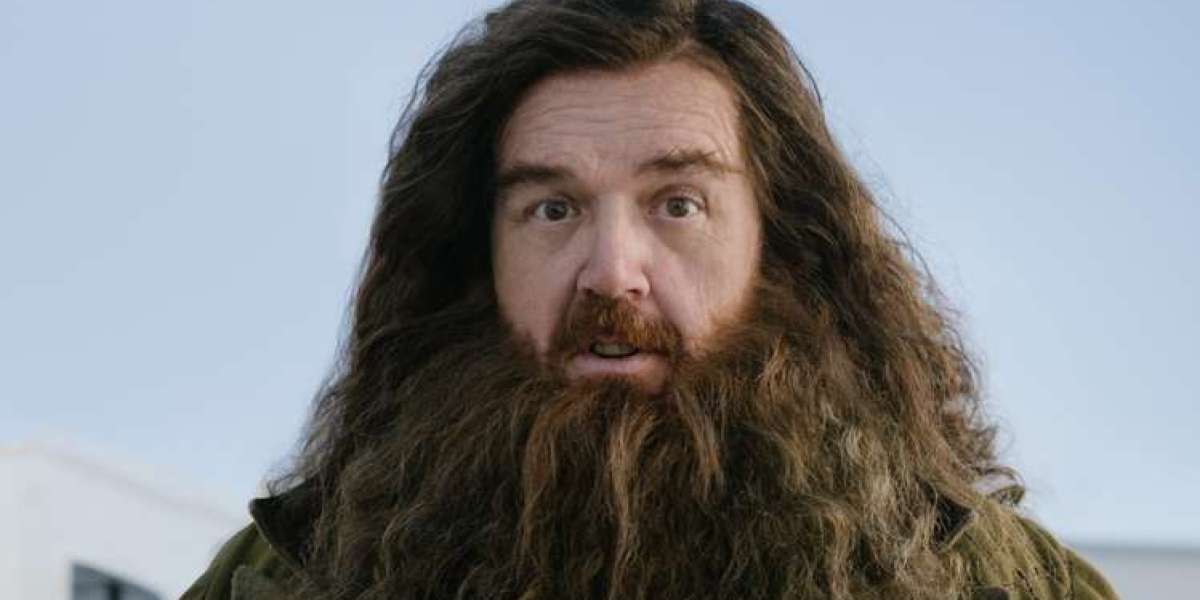

Hallmark's Fantasy Series: Tales From a Neverending Story

Ved sh erGrandbet88: Platform Slot Online Terpercaya dan Paling Lengkap di Indonesia

Ved stephen graver Menjelajahi Provider Slot Terbaik di HOKI69 – Mana yang Paling Gacor?

Ved Hoki69 car

Menjelajahi Provider Slot Terbaik di HOKI69 – Mana yang Paling Gacor?

Ved Hoki69 car AGEN69: Panduan Lengkap untuk Pemain Judi Online

Ved vip bet88

AGEN69: Panduan Lengkap untuk Pemain Judi Online

Ved vip bet88